Update! The rules were announced and the vote passed. See our summary and analysis here:

http://crowdexpert.com/investment-crowdfunding/new_jobs_act_titleiii_rules_overview_first_thoughts/

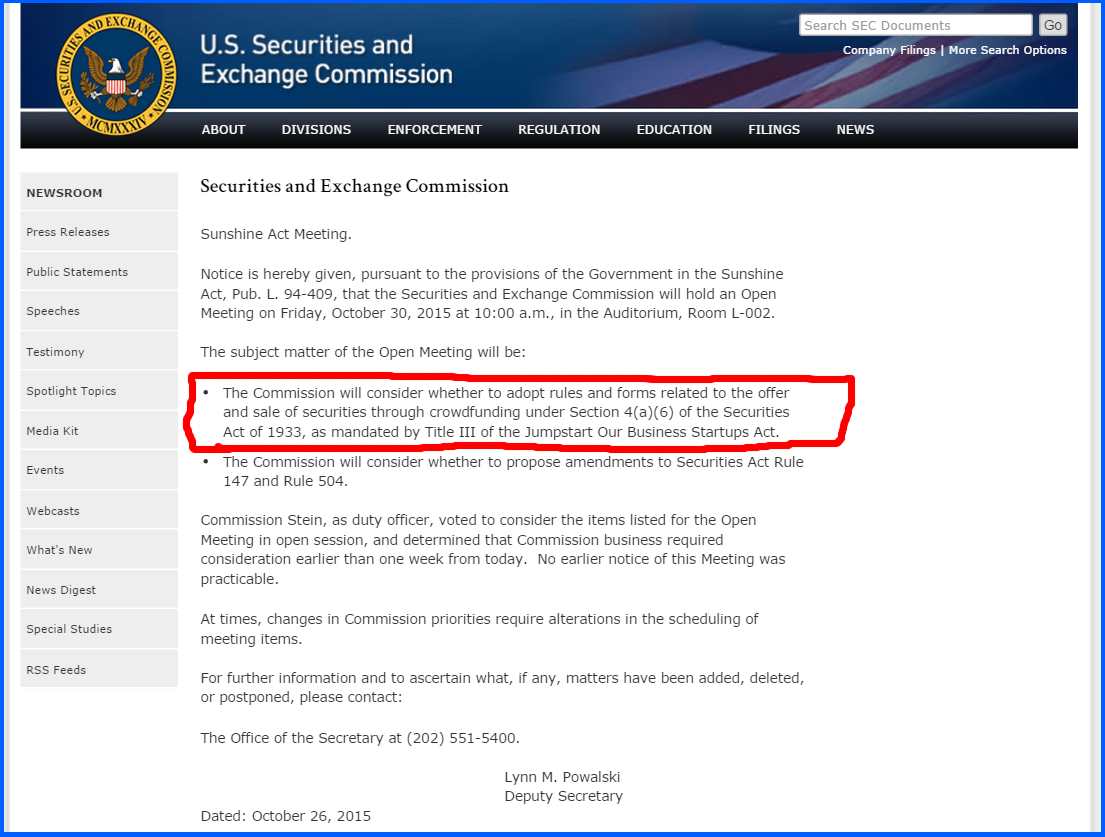

The SEC will finally be announcing and voting on the JOBS Act Title III Crowdfunding rules on Friday October 30th.

The SEC is also scheduled to discuss the JOBS act on their November 19th meeting:

.There is a lot of hand-wringing that the final rules will be bad, that they will put too expensive a regulatory burden on startups trying to raise one million dollars or less.

House Appropriations Committee recently wrote the SEC a scathing letter scolding them for not implementing Title III and for planning bad rules. Here’s an excerpt:

“Crowdfunding.—The Committee is concerned that the SEC’s proposed crowdfunding rule by the SEC will be inoperable. The Committee believes that the Commission has an obligation to consider the effects of the proposed rule upon the efficiency, transparency, and affordability for small companies and investors seeking crowdfunding offerings. Impairing or restricting the use of crowdfunding offerings could potentially result in limiting small businesses from securing much needed, early-stage capital formation and liquidity. The Committee believes that before the final crowdfunding rule is promulgated, the Commission should ensure that the regulations neither disproportionately stifle small company growth, nor create barriers to entry for investors, thereby hindering diversified investment options. Specifically, the final rules should carefully consider how the proposed changes would affect the following:

(1) the burden and costs associated with providing audited or reviewed financial statements;

(2) the harm caused by increasing liability for the platforms, portals, and intermediaries’ and thereby their ability to curate and effectuate crowdfunding offerings;

(3) restricting the economic interests of the intermediaries from revenue derived from crowdfunding offerings;

(4) burdensome disclosure report requirements; and (5) the investors and companies’ capacity to aggregate and diversify through investment vehicles to heighten investor and issuer protections.”

(Thanks to Sam Guzik for bringing this to my attention.)

While title III rules will be the biggest news, the changes to Rule 147 and Rule 504 will be important as well for smaller companies that do state-level fundraising.

The Rule 147 changes would help intrastate crowdfunding, active in about 30 states but which has been slow to gain traction. In September, the S.E.C. Advisory Committee on Small and Emerging Companies recommended changes that included eliminating the ban on advertising that might reach people outside of the state where the offering is being conducted, and loosening the strict requirements defining an in-state company.

The Rule 504 changes would make it easier to coordinate equity crowdfunding raises across neighboring states, and would possibly raise the $1 million cap on the amount of money that companies are allowed to raise per year under the rule.

You can discuss this article on our LinkedIn Group Here:

https://www.linkedin.com/grp/post/6568366-6064799155438575616?trk=groups-post-b-comment

— Original Article —

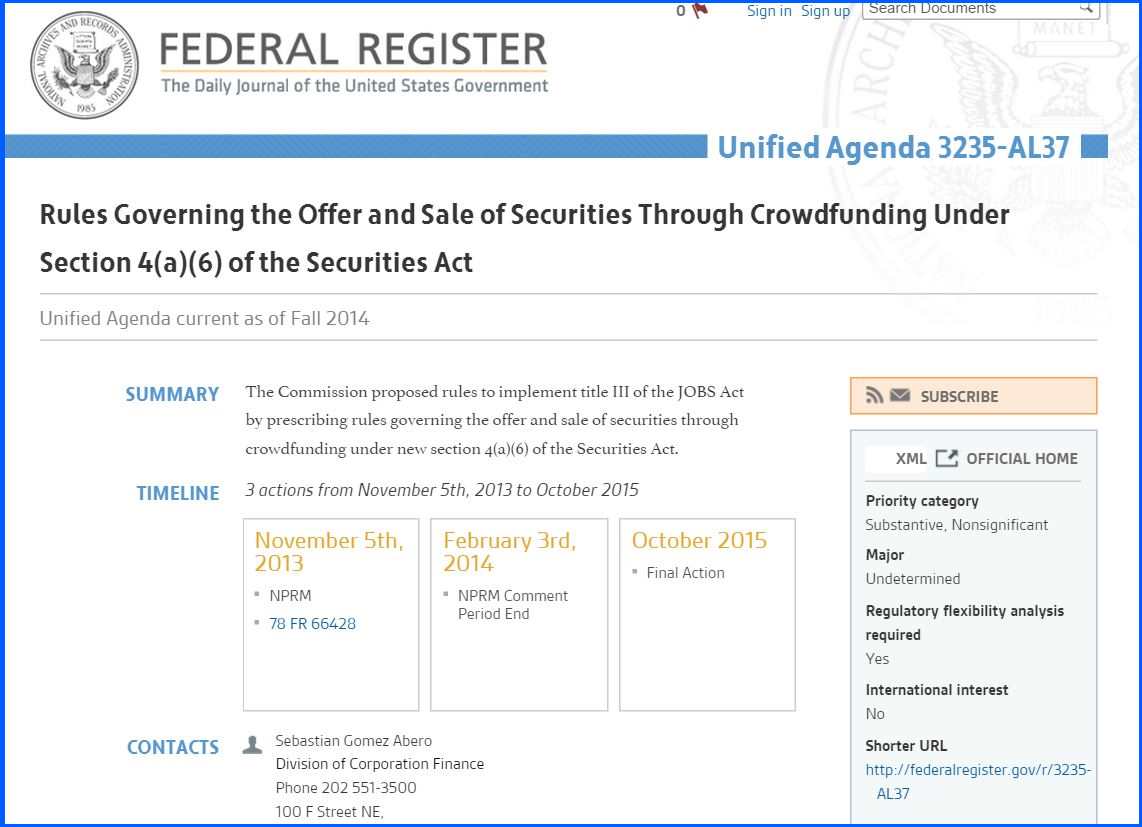

In a recent schedule update, the SEC has subtly announced that they finally plan to implement the JOBS act TitleIII rules, pertaining to investment crowdfunding for non-accredited investors, in October 2015.

See for yourself here: http://www.reginfo.gov/public/do/eAgendaViewRule?pubId=201410&RIN=3235-AL37

TitleIII will allow anyone to invest in startups online. Currently only accredited investors, individuals earning over $200k per year, or $300k with spouse, or with a net worth above $1million, or qualified institutional buyers are allowed to invest in startups and other private offerings online via crowdfunding.

Investment Crowdfunding platforms such as AngelList, FundRise, RocketHub, CircleUp, FundersClub, SeedInvest, and many others have been waiting for these rules to go into effect since president Obama signed the JOBS act on April 5th 2012.

TitleIII will include limitations on how much of their income or net worth an individual can invest, and how much a company can raise through investment crowdfunding, as well as lay out the requirement that crowdfunding portals, platforms, and marketplaces will have to follow when selling to unaccredited investors.

Still, this is a big deal, and something to look forward to in 2015!