With all the excitement around the big SEC Title III Equity Crowdfunding announcement on Oct 30th it’s easy to overlook the fact that the SEC already enabled a potentially much more powerful set of rules earlier this year, which we are only now starting to see the effects of.

Equity Crowdfunding With Reg A+ is Now In Effect

While TitleIII Equity Crowdfunding will open up the opportunity for many early stage startups to raise up to one million dollars using online crowdfunding platforms, Regulation A+ which went into effect June 19th 2015 allows medium sized companies to raise up to $50 million online.

Reg A+, as a quick refresher, is a new set of SEC rules which allow private companies a streamlined process to raise money from investors. Title IV of the JOBS Act reformed the old Regulation A exemption by splitting it into two tiers: Tier 1 allows companies to raise up to $20 million in any 12-month period with minimal ongoing SEC reporting requirements, but with the offering subject to “blue sky” state securities laws, requiring the issuer to register and comply with different regulations in each state they offer securities in. Whereas Tier 2 allows companies to raise up to $50 million and is exempt from blue sky regulation, but does add ongoing SEC reporting requirements. Both tiers of Reg A+ permit testing-of-the-waters, confidential filing of the offering statement, general solicitation, sales to unaccredited investors, and can also be potentially exempt from the shareholder limitations under the Exchange Act.

So now that Reg A+ has been in effect over the summer and half the fall, what trends are we seeing in its use? What kinds of companies are taking advantage of the new regulations? How are funding platforms facilitating Reg A+ offerings? And how, if at all, is the Main Street, unaccredited investor taking advantage of Reg A+?

Too Early to the Party?

Unfortunately, even with the benefit of several months we have not yet seen an outpouring of Reg A+ offerings. The biggest reason is that it takes 4-8 months to get complex regulatory filings, such as those required by Reg A+, through the SEC (not to mention state filings if proceeding under Tier I). Even those Reg A+ offerings that have gone past the testing-the-waters phase are suspected to have begun the filing process back under the old Reg A regime in order to get the filings approved by the SEC in time to take advantage of Reg A+ as soon as it came into effect.

In a keynote address on Oct 28th 2015 SEC Chairman Chair Mary Jo White gave us the following update:

As for Regulation A+, which just became effective in June, it is obviously too early to draw conclusions. Companies are beginning to take advantage of the new rules in greater numbers than was the case under the prior version of the exemption, with approximately 34 companies publicly filing offering statements and 16 companies filing non-public draft offering statements. The staff has qualified three offerings so far, and it remains to be seen how investors will react to such offerings.

– SEC Chairman Chair Mary Jo White

So that’s it, only 3 offerings qualified so far. We’re just getting started.

We spoke to one of our favorite experts in the Investment Crowdfunding space, Sara Hanks, CEO at CrowdCheck, a provider of due diligence services for crowdfunding platforms, for her perspective:

“It takes time to put together an SEC filing. Even though the Form 1-A is simple compared to a full SEC registration, it’s still a grown-up SEC filing with all the SEC rules. Additionally, securities lawyers are some of the most conservative creatures on the planet. I hear that a lot of them are dissuading their clients from using Reg A until they see what the market looks like.”

– Sara Hanks, CEO @ CrowdCheck

June 19th was about 4 months ago, so given the 4-8 month estimate of filing time, we should be seeing the rest of the first round of Reg A+ offerings open for investment coming online between now and February 2016. If those work out, then there will likely be a second wave mid-next-year.

Consumer products and consumer-facing companies are expected to be big users of Reg A+ once the process is more established. Evangelist customers of popular products interested in investing in the company to help fuel its growth. The most famous use of the old Regulation A rules was actually by Ben & Jerry’s ice cream. With the slogan “Get a scoop of the action,” Ben & Jerry’s raised $750,000 from 1,800 ice-cream-loving Vermonters in 1984, allowing them to build a new plant and expand, and setting the stage for a $5.8 million initial offering the following year.

Sara Hanks points out how retail companies specifically will have a more difficult time with Reg A+, as the filings require an audit, which for retail companies means a physical audit of their inventory.

“For example, I know of two companies that cannot file with the SEC because they’ve only just engaged their accountants for their audit. Both are retail companies with actual sales. Which means inventory. An auditor has to physically examine the inventory both at the beginning of the audit period and the end. Obviously, accountants can’t go back in time and count stuff from a time before they were engaged, so both these companies are going to have to wait for a bit before they can get clean audit opinions.”

– Sara Hanks, CEO @ CrowdCheck

This doesn’t mean we won’t see more consumer companies using Reg A+ the way Ben & Jerry’s did, just that it will take them longer to prepare their offerings for SEC compliance.

We’ve also seen companies in the real estate industry express interest in utilizing Reg A+ as an additional source of capital for development beyond bank loans or large private equity investors; retail investors seeking to diversify their portfolio may also be interested real estate securities tied to specific properties, rather than investing in REITs or aggregated mortgage-backed securities.

Fundrise, EarlyShares, and GroundFloor are real estate investment crowdfunding platforms to keep an eye on, as they have expressed interest in utilizing Reg A+ to make offerings available to unaccredited investors.

Reg A+ Is Expensive

Reg A+ is not for startups looking for seed crowdfunding for their new idea.

“Regulation A+ is not likely to be suitable for an early stage company. Rather, it will most likely be useful for companies that have raised capital already, but now want to raise a significant amount of additional capital (up to $50 MM). They have the financial resources to hire the lawyers and accountants necessary to engage in the process of a Regulation A+ offering, but not the resources to engage in an IPO.”

– Alexander J. Davie, Securities Attorney

According to CrowdFund.co: “In all, the costs are likely going to range somewhere between $40,000 and $100,000 for the front-end and 1% to 10%+ for the back-end.”

- Attorney filing fees. Filing your Form 1-A with the SEC: $25,000 to $80,000

- Accounting & audit costs. Both Tier 1 and Tier 2 of Regulation A+ require two years of audited financials. The second tier simply requires a bit more in terms of ongoing reporting, which adds to the complexity and cost. Tier 2–while a bit more onerous on the reporting side–pre-empts the state Blue Sky laws : $12,000 to $30,000

- Broker-dealer and other promotional costs.: 5-10%+ depending on investor relationships

These fees should come in time down as providers get accustomed to the new workflow and more attorneys, accounts, and broker-dealers start providing Reg A+ compliance services.

The moniker of “mini-IPO” makes sense for Reg A+ offerings. In addition to the initial registration process, submission of ongoing audited financials to the SEC is required. Though not as strenuous as the PCAOB requirements that public companies adhere to, it is still a significant cost and effort for startups.

For context keep in mind that a real full IPO costs the company raising money on average $2.6 million dollars in registration, legal and financial service fees, and raises an average of $100 million dollars. So there is huge potential here for Reg A+ to allow medium sized companies to raise money that were not yet ready for a standard IPO.

Success Stories So Far

Given the long lead-time necessary for a company conducting a Reg A+ offering to get its regulatory filings through the SEC and state securities regulators, true success stories in the form of completed offerings with money in the bank are far and few between. However, several companies have had very successful “testing-the-waters” periods, where investors expressed non-binding interest in participating in a potential Reg A+ offering by the company.

For example, ElioMotors, a startup that aims to develop an ultra-high mileage, low-cost, three-wheeled vehicle with the same comfort and safety as traditional automobiles, hosted a testing-the-waters campaign on StartEngine, an equity crowdfunding platform using Reg A+ and open to unaccredited investors. (Check out our CrowdExpert interview with CrowdFundX, the marketing agency behind Elio’s groundbreaking campaign.)

In 19 days Elio was able to to secure stated interest from 5000 investors to the tune of $16 million, with the company considering a Tier II offering of $25 million. Though it remains to be seen to what degree people who say they would like to invest actually write a check when the offering goes live.

StartEngine Elio Testing-the-Waters Campaign Screenshot:

StartEngine has positioned itself as the front-runner in Reg A+ equity crowdfunding offerings. On the opening day of the new Reg A+ rules going into effect, June 19th 2015, StartEngine had 4 companies live doing testing-the-waters campaigns including Elio.

In a recent StartEngine newsletter sent on 10/26/15 the platform stated “We are just weeks away from our first live share offering on StartEngine. To prepare, our development team is hard at work putting the final touches on our payment and escrow integration. “. This first offering will most likely be Elio. This shows how the platforms are also rushing to figure out all the behind-the-scenes details required for executing fundraising with SEC compliance for Reg A+.

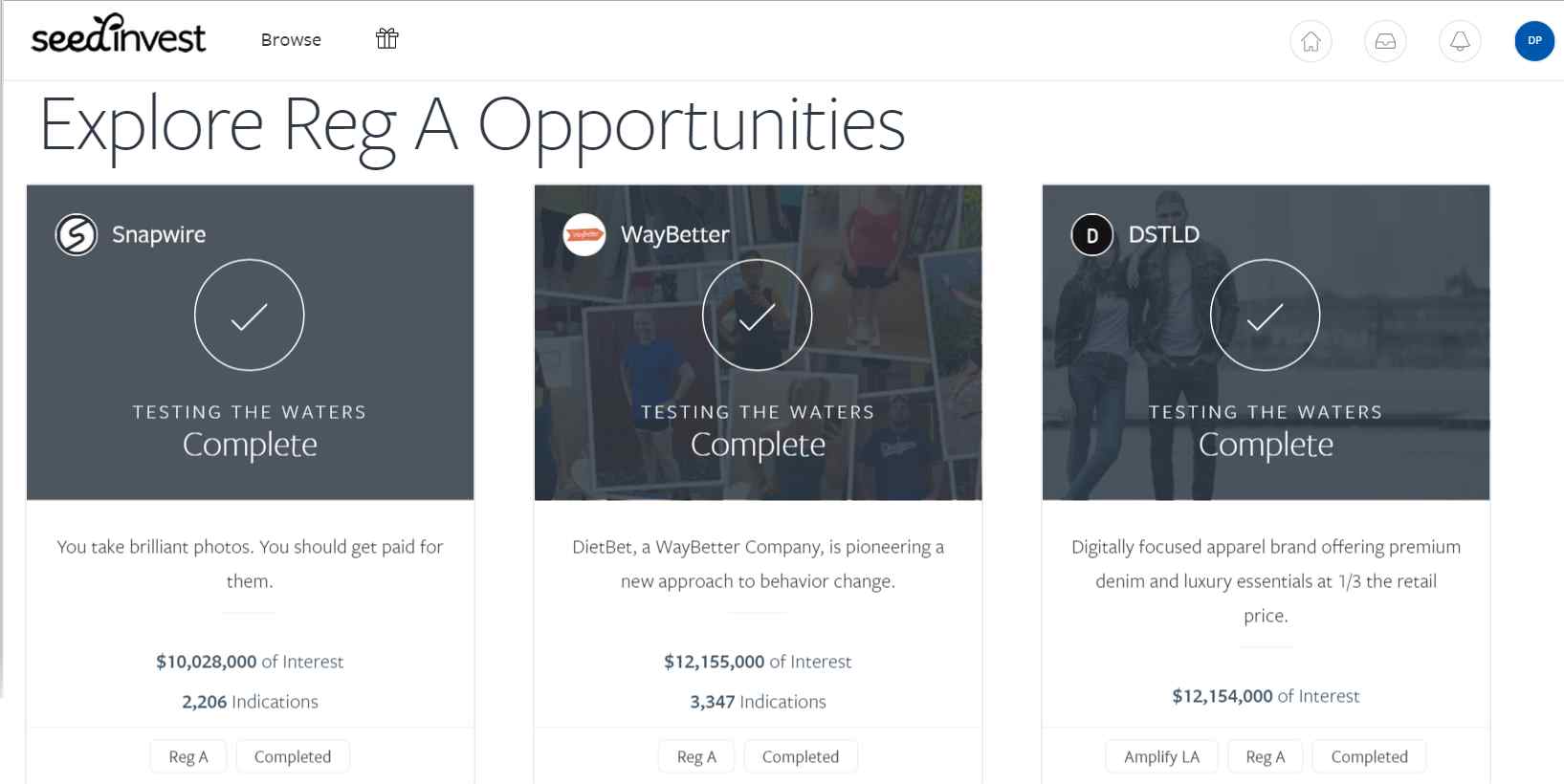

DSTLD, a direct-to-consumer premium denim apparel company, also received significant interest during its testing-the-waters campaign on SeedInvest, receiving interest from 1,900 accredited and unaccredited investors to raise more than $12 million. SeedInvest has to date completed three Reg A+ testing-the-waters campaigns.

SeedInvest Reg A+ Offerings Screenshot:

Both Elio Motors on StartEngine and DSTLD on SeedInvest are using the “testing-the-waters” allowance in Reg A+ to solicit investors to commit interest in purchases of company stock before completing their offering registration with the SEC.

Another often cited best potential use of Reg A+ is by consumer companies with an existing large audience to bring their most passionate customers on as shareholders in the company.

“Where the real revolution is: companies that already have a crowd (users of the equipment, players of the game, viewers of the movies, readers of the comic). They can sell to their own evangelists.” – Sara Hanks, CEO @ CrowdCheck

The reportedly first successfully closed Reg A+ offering was perhaps less than successful. Real estate crowdfunding platform GroundFloor utilized Reg A+ to raise funds by selling convertible notes and preferred stock backed by 7 pre-identified property loans, totaling $545,000. GroundFloor chose to make the offering available in only 9 states. But GroundFloor’s regulatory disclosures also revealed that the company spent $496,000, if not more, in legal, accounting, and filing fees as it raised from the offering. (Breakdown: $30,000 on auditing fees, $458,000 in legal fees, and $6,000 in blue sky fees.)

It looks like GroundFloor was able to get this offering through the SEC so much faster than everyone by piggybacking off of their previous old Regulation A offering form April 2014. So technically they were able to get their offering live within five months for Reg A+ Tier 1 approval, but really it is a reflection of about 18 months of work on their part. Also because it is a Tier 1 offering it is subject to individual state Blue Sky laws and Groundfloor has also only chosen to sell in 9 states.

Given the finances of this offering it seems to be almost symbolic, GroundFloor proving that it can be done, even if it wasn’t profitable the first time around. (Kudos!)

Platforms Using Or Planning to Use Reg A+

A number of funding platforms are beginning to take advantage of the Reg A+ exemption by facilitating offerings under the exemption on their platforms. Crowdfunding platforms such as SeedInvest, Fundrise, and Crowdfund.co are permitting or are planning to permit companies to utilize Reg A+ for offerings on their platforms. Some platforms, such as StartEngine, are basing their platforms solely on the Reg A+ process. Most of these platforms are full-service providers, providing a platform for both the testing-the-waters phase along with the actual sale phase, and managing due diligence, purchase agreements, and regulatory filings. Other companies, such as FundPaas and FundAmerica, have developed back-end platforms that companies and their advisors can use on their own websites to manage Reg A+ offerings.

| Reg A+ Equity Crowdfunding Platforms |

|---|

| StartEngine | SeedInvest | Banq.co | FundRise (Real Estate) |

EarlyShares (Real Estate) |

CrowdFund.co (Not Yet Operating) |

What Opportunities Does Reg A+ Offer Unaccredited Investors?

This is a big new opportunity for individual investors who have the capital and desire to take on a more medium level of risk, to capture the huge growth opportunities of investing companies that are still young, but with more established traction and success than very early stage startups.

While Reg A+ (and Regulation A before it) was intended as a “mini-IPO” that would allow unaccredited investors to invest in companies alongside accredited investors and funds, not all platforms are facilitating access for unaccredited investors. SeedInvest, for example, while open to companies using Reg A+ on their platform, so far has only provided access to Reg A+ testing-the-waters offerings to accredited investors.

Despite the intent to have Reg A+ serve as a mini-IPO, unaccredited investors may nonetheless find themselves shut out of such deals, as there are still a number of regulatory and administrative hurdles that come along with having unaccredited investors. First, Reg A+ Tier I offerings are still subject to state regulation and registration requirements, which can severely limit the amount of unaccredited investors that can participate in a round if a company seeks to use state-level exemptions rather than registering the offering (although the North American Securities Administrators Association’s Coordinated Review Program is intended to relieve the burdens of state registration by allowing companies to submit one filing for registration in all the states participating in the Program).

Moreover, having a large number of investors, both accredited and unaccredited, can lead to the “too many cooks in the kitchen” problem, as the company now has the administrative burden of making sure all the proper legal notices are sent to shareholders, that they are given proper opportunity to exercise their legal management rights, and ensuring that they are satisfied with the progress of the company.

Companies may end up using Reg A+ without any intention of taking investment from the typical retail investor, as companies may be simply trying to take advantage of some of the features of Reg A+, including testing-the-waters, confidential filing, and general solicitation, without the burdens of having to ensure the accredited status of participating investors or having to register under state law if conducting a Tier II offering.

Doing It Wrong

There have been approximately 35 Form 1-A filings uploaded to the SEC’s EDGAR filing website, plus 16 that have chosen to file confidentially. This spike in usage of Reg A+ seems like a clear success for the new rules, but some of these filings are repeats or improperly filed.

Sam Guzik, one of our favorite securities attorneys in the equity crowdfunding space has a fantastic blog entry picking apart an LA based media company called Punch that was one of the first to file under Reg A+ which it did wrong in various hilarious/fraudulent ways, including posting eight days before the rules even went into effect, not posting the required SEC legends on their testing-the-waters materials, and not having filed their required quarterly reporting with the SEC since 2007.

Sara Hanks has a few good stories about companies filing improperly as well:

There have been some public filings under Regulation A, but many of those were immediately amended due to filing errors. You’ll see several filings by Alternative Securities Markets or entities affiliated with it. ASM was just sued by the SEC for purporting to help companies file under Reg A when they know nothing about securities law (among a host of other frauds). I think there are three ASM filings. There are also four related filings by companies with “Rural Broadband” in their name. These were filed by a disbarred Florida attorney who is using the wrong form. What is clearly happening here is the SEC keeps saying “use the right form” and he keeps filing wrong. Then there were a few filings in the early days by lawyers who clearly weren’t familiar with SEC rules including things like when the SEC says “audited financials” they mean it even if you are recently formed, and don’t check the box saying you are filing audited financials unless you are actually filing audited financials. Later filings have been of higher quality. – Sara Hanks, CEO @ CrowdCheck

The Future of Reg A+

The hope behind reforming Reg A was to encourage greater adoption of the exemption by increasing the maximum capital to be raised while reducing some regulatory burdens. It appears to have worked to some extent — since Reg A+ went into effect.

Even with the early mistakes and missteps cited above, the number of legitimate Reg A+ offerings already exceeds the number of Reg A offerings completed under the old regime over the past few years — for example, only 8 Reg A offerings were undertaken in 2012. So the new rules are seen as a big improvement over the old ones, as issuers are using them, and this should continue to grow as more hesitant companies see these early trailblazers successfully raise money using Reg A+.

On the other hand if these early adopters face significant regulatory or administrative burdens or find the process to be not a cost-effective form of capital formation, Reg A+ may fizzle out like its predecessor.

Right now the next step is for us to just sit back and observe what happens with the 47 Reg A+ offerings currently in the SEC approval queue as they go live.

State securities regulators have levied significant objections to Reg A+, in particular Tier II that preempts state oversight, including both Massachusetts and Montana bringing court challenges. It is possible that states may try to shut down Reg A+, not by regulating the sale of the securities (which the courts may ultimately rule are properly preempted from state review under Tier II), but by regulating *who* can sell securities by expanding the sphere of persons and entities who must be licensed as broker-dealers — states could require issuers to become broker-dealers in its own securities.

Given the potential to raise far greater amounts of capital, and the fact that it is already in effect, some industry watchers (CrowdExpert.com included) have suggested that Reg A+ may end up being a more impactful equity crowdfunding mechanism than Title III of the JOBS Act, which is the equity crowdfunding exemption that everyone has been waiting for since the JOBS Act’s passing back in April 2012. The percentage of the maximum capital raised that would have to go to paying the lawyers, accountants, and other administrative costs necessary to fulfill the regulatory requirements for each exemption is far less with Reg A+, where up to $50 million can be raised, than with Title III, where only up to $1 million can be raised. Once things speed up with Reg A+ it might be Title IV that proves to be the part of the JOBS Act that really enables the investment crowdfunding revolution, finally allowing startups to raise from the public money more easily than a full IPO, and allowing regular unaccredited investors to invest in startups, growth companies, and other alternative investments that they previously did not have access to.

Another future benefit we may see out of a takeoff in Reg A+ offerings is the facilitation of secondary trading of equities in startups and private companies. Unlike securities offered under Regulation D, Reg A+ equities are freely transferable; Reg A+ also provides limits for resales of securities under an offering. With the rise of platforms that will facilitate Reg A+ offerings, there may be a shift into secondary trading of equities, especially if unaccredited investors in Reg A+ offerings seek to have the same liquidity in their private company equities as the publicly-traded stocks they purchase on the NYSE or NASDAQ. With the recent acquisition of SecondMarket by NASDAQ, and OTC Markets doing a lot of PR in the Crowdfunding space lately, secondary trading of Reg A+ of securities that were initially crowdfunded may be a very interesting area to keep an eye on in the future.

Thoughts? Comments? Feedback? Corrections? Discuss this article on the CrowdExpert LinkedIn Group here: https://www.linkedin.com/grp/post/6568366-6065527471841832962?trk=groups-post-b-title