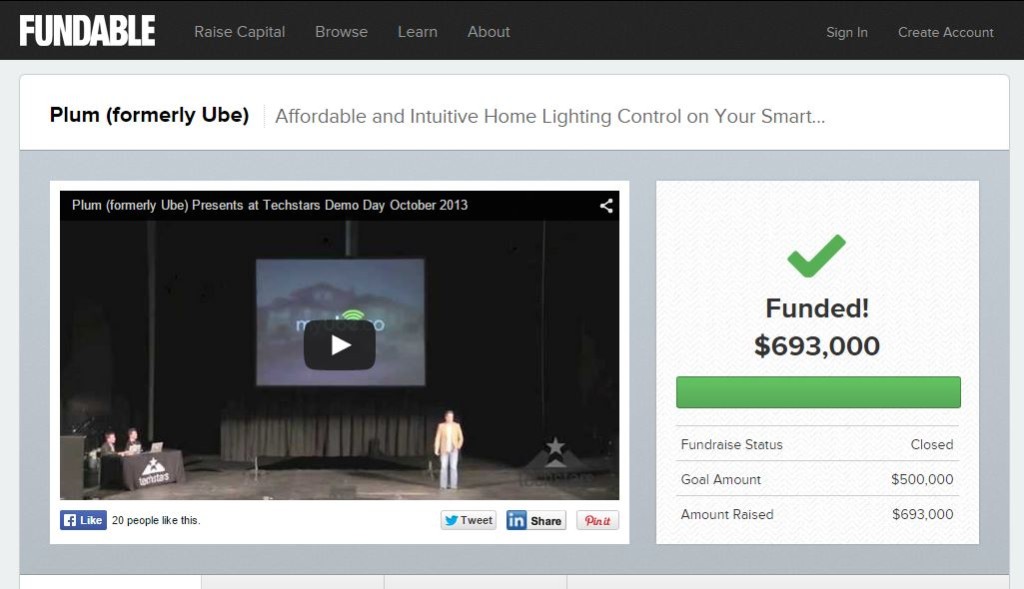

Plum Raises $693,000, more than meeting a $500,000 Goal on Fundable

Advice for Fellow Crowd Funders

As a successful crowdfunder, Utz Baldwin receives a lot of information requests from entrepreneurs.

His advice includes:

- Managing the investor pipeline by using spreadsheets and entering people into a CRM program. “Remember to record your last conversation and track everything,” he says.

- Interacting with the platform. “If you just build a blind platform the chances of success are lower,” he says.

- Building a strong investor communications pipeline. “Reach out to those who may have forgotten all about you when you have something to share,” he says. “Ask them how they’re doing.”

- Plan campaigns well ahead of time and make sure they are newsworthy. Try and release newsworthy information during the campaign, such as winning a competition. “The key is to get Fundable to advocate on your behalf, so form a PR strategy prior to campaign,” Baldwin says. “Build in milestones and accolades newsworthy enough to get into newsletter.”

- Be clear on your campaign and the law. Baldwin “strongly suggests” understanding the laws around crowd funding and speaking to an attorney who understands corporate law.

The Limitations of a Local Investor Pool

When Utz Baldwin launched his company Plum, he wanted to build a big Texas company, though it was far from investor-rich Silicon Valley. However, as Baldwin’s team pursued the normal funding avenues, such as angel groups and investors, they ran into limitations. “We spent a lot of time scheduling meetings in coffee shops and trying to get introductions,” Baldwin says. “There are only so many investors in an area interested in a particular niche.”

Plum was founded to develop disruptive technology in the home connected industry. Baldwin has 25 years of industry experience and was the former Chairman and CEO of CEDIA, an industry global trade organization. The company developed the Plum LightPad: a reimagined the light dimmer connecting to home Wi-Fi networks. The lightpad allows people to control home lighting from a smartphone, from anywhere in the world.

To accelerate Plum’s growth, Baldwin required access to a wide pool of interested investors from around the country.

Finding Investors on Fundable

As Baldwin was researching crowd funding options, he came across an article on Fundable. He found Funable’s website highly intuitive with profile companies that “had a good mix of consumer offerings.” After Baldwin began setting up a profile, Fundable staff reached out. “One of the best things about Fundable is the engagement of that team is second to none,” Baldwin says. The staff commitment convinced Baldwin he’d found Plum’s crowd funding platform.

As Baldwin created a profile, writing copy and adding video, he learned Fundable offered two options. One was to pay a monthly fee and run the campaign personally. The second option was paying a one-time up-front fee for White Glove service. He opted into the specialized service, where Fundable staff “help build your profile and polish the marketing, everything from producing graphic assets and to helping lay out a profile.”

Baldwin accessed Fundable’s resources and worked with a platform funding adviser. “They walk you through business models and what your raise looks like, articulate the size of funds and offer advice on what a minimum investment should be,” Baldwin says.

The most valuable resources Fundable had to offer for Baldwin was inclusion in the platform’s newsletter. “It goes out to 40,000 investors and immediately primed us,” he says. Before the Plum campaign launched, Baldwin and his team prepared what they needed to know about their business plan.

The preparation required team members to understand a process for handling investor relations. Staff members learned that once interested investors like a public profile, they can request access to more detailed information. The crowd funding campaign manager is then notified and must conduct due diligence on the investor. Next, the campaign manager clicks a button, granting investor access to the view offering, financial data and more confidential company information.

Once the team was prepared, “we spent about a week to 10 days getting everything ready. Within two weeks, we launched our campaign,” Baldwin says.

Connecting with and Converting Investors

As soon as Plum’s campaign launched, interested investors clicked on Plum’s public facing profile. “On a normal day we would receive 50 to 100 views,” Baldwin says.

Ten per cent of those viewers requested access to go beyond the public facing profile. Of this group, 10 per cent moved on to phone conversations. On Fundable, the campaign manager also gets the investor’s direct contact information. “You can schedule a call to get better acquainted,” says Baldwin. “Our close rate on the phones was approximately 85 per cent.”

While Baldwin had sought American investors, and secured investments from working and retired executives in Silicon Valley, he also landed a Mexican national race car owner and the owner of a string of bakeries in the United Arab Emirates (UAE). “We were very pleased with investor numbers and quality,” Baldwin says.

Baldwin set up a system to track investment interest, not only from investors but also from those who showed interest. He set up an automated email response and keeps in touch with a newsletter. “Once you begin taking money from outside investors, you want to have a system in place to communicate regularly and often at least once a month with regular updates.”

Investors have helped Baldwin with more than funding. One of his investors owned a global recruiting company and helped hire for a particular position, free of charge. “Investors have a vested interest in your success and are happy to help,” he says. “They’re excited about your company. Get to know them when they talk to them, find out what they’re strengths and interested are, collect it and use it later.”