Whenever we come across some good investment crowdfunding industry statistics we’ll add them to this page for easy reference:

———————————————————–

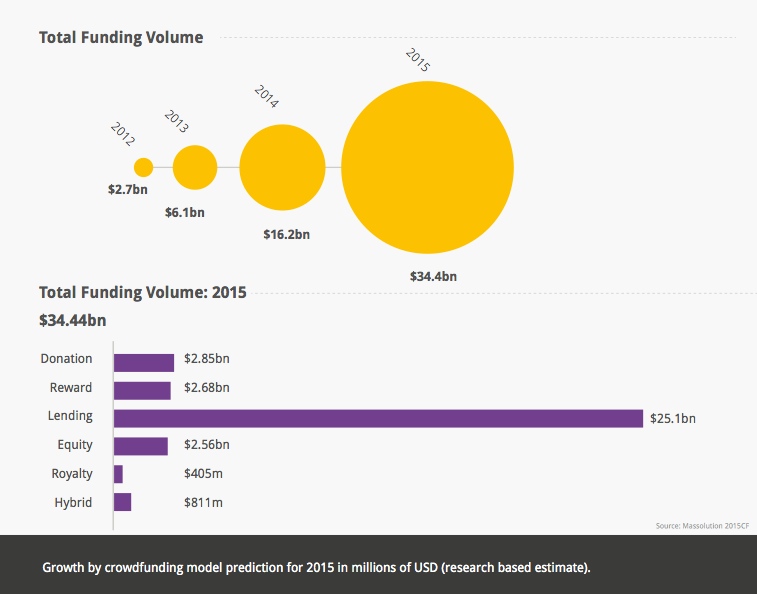

Massolution Crowdfunding Industry 2015 Report

- Total Global Crowdfunding Industry estimated fundraising volume in 2015: $34 Billion

Breakdown:- P2P Lending $25B

- Reward and Donation Crowdfunding: $5.5B

- Equity Crowdfunding $2.5B

By Region:North America $17.2B, Asia $10.54B, Europe $6.48B, Oceania $68.6M, South America $85.74M, Africa $24.16M:

By Region:North America $17.2B, Asia $10.54B, Europe $6.48B, Oceania $68.6M, South America $85.74M, Africa $24.16M: Note: Including P2P/Marketplace Lending as a form of crowdfunding really inflates these statistics, as it consists of 71% of the total, and most companies in the P2P/Marketplace Lending space would not call themselves crowdfunding. Though even without P2P included, $10Billion is still an impressive figure.

Note: Including P2P/Marketplace Lending as a form of crowdfunding really inflates these statistics, as it consists of 71% of the total, and most companies in the P2P/Marketplace Lending space would not call themselves crowdfunding. Though even without P2P included, $10Billion is still an impressive figure.

Source: Massolution/Crowdsourcing.org 2015CF Crowdfunding Industry Report

URL: http://reports.crowdsourcing.org/index.php?route=product/product&product_id=54

Date: March 31, 2015

———————————————————–

Massolution Real Estate Crowdfunding Industry 2015 Report

- Real Estate Crowdfunding Set to Be $2.5 Billion Industry in 2015.

- Real estate crowdfunding grew 156 percent in 2014, just breaking the $1 billion mark, with campaigns ranging in size from less than $100,000 to over $25 million.

- In 2014, North America stood as the largest region by funding volume at 56 percent market share, compared with Europe at 42 percent.

- By 2015, Massolution forecasts that North America will retain its lead, reaching $1.4 billion in funding volume, but Europe will have just broken the $1 billion threshold.

- Overall, real estate crowdfunding is expected to increase by 150 percent, equaling $2.57 billion in 2015, making it one of the fastest-growing industry segments of crowd capitalism.

- This year, U.S. commercial and industrial property crowdfunding expects to see a 250 percent increase.

- Growing investor interest in crowdfunding platforms is proving crowdfunding to be a legitimate source of funds as compared to traditional banking.

Source: Massolution/Crowdsourcing.org 2015CF Real Estate Crowdfunding Industry Report

URL: http://reports.crowdsourcing.org/?route=product/product&product_id=52

Date: March 03, 2015

———————————————————–

CrowdExpert.com Investment Crowdfunding Industry Size Estimate:

- “Investment Crowdfunding, like any industry, has a tendency to parade around exaggerated statistics. Everyone likes a big number. The two most popular I’ve been seeing lately are an estimate from a Massolution study that pegs crowdfunding volume at $35 Billion globaly in 2015, and a World Bank commissioned study that hypothesizes that global crowdfunding could grow to $96 Billion by 2020.The Massolution number includes Peer-to-Peer/Marketplace lending in their aggregate figures, which account for $25 billion of the $35 billion, and the world bank number is a best-case-scenario argument showing what could happen if countries were to implement recommended policies. We track US Equity Crowdfunding volume at $1.2 Billion in 2015, not including Peer-to-Peer Lending or Real Estate Crowdfunding, which is still very impressive. ” – David Pricco, Editor @ CrowdExpert.com

- CrowdExpert.com, which maintains a database tracking activity across the top 35 investment crowdfunding platforms estimates US Investment Crowdfunding in startups volume at approximately $1.2 Billion in 2015. This only includes primary offerings, non real-estate or personal lending, facilitated by online investment portals which use the new JOBS Act online fundraising rules. CrowdExpert.com tracked an additional $900 Million in 2015 US Real Estate Crowdfunding activity. These figures combine to a $2.1 Billion Estimated Total US Investment Crowdfunding Volume for 2015.

- “We track US industry wide crowdfunding data by adding together all the offerings we see across major platforms in our index. We saw about $2 Billion in US investment crowdfunding activity in 2015, approximately half of which was real estate and half of which was startups. The vast majority of these investments are only available to accredited investors. We don’t include P2P Marketplace lending in our crowdfunding figures.We’re expecting 75-100% growth in US equity crowdfunding volume of capital raised in 2016, approximately $3.5 to $4 billion.The vast majority of that will still be from regulation D Rule 506 offerings only available to accredited investors, but with a small but growing share coming from Regulation A+ offerings as several platforms scale up their process for bringing those offerings online. Title III Regulation Crowdfunding will get a lot of press as interesting projects come online using the new rules, but won’t raise a large volume of capital in 2016 due to the $1 Million issuance limit.” – David Pricco, Editor @ CrowdExpert.com

Source: CrowdExpert.com 2015 Industry Statistics

URL: http://crowdexpert.com/crowdfunding-industry-statistics/

Date: February 29th 2016

———————————————————–

PENSCO Crowdfunding Report 2015

- Many IRA holders do not realize that in addition to traditional exchange-traded assets like stocks, bonds and mutual funds, they can also invest in assets that traditional financial institutions don’t offer, such as limited partnerships, private equity and real estate. The total assets in individual retirement accounts (IRAs) reached $7.3 trillion in 2014,16 and investments can be made from self-directed IRAs through crowdfunding portals with alternative asset custodians.

- Rule 506(c) offerings represent less than 10% of all 506 fundraising campaigns. The observed median investment size of Rule 506(c) offerings is about $1,000.

- Accredited investors benefit from “Regulation D” (Reg D) by the Securities and Exchange Commission (SEC). This establishes rules for entrepreneurs who want to raise capital without having to register with the SEC. It saves considerable money and red tape, and a portion of the Regulation, “Rule 506,” allows for an unlimited amount of capital to be raised from accredited investors. The combination of these benefits has made Rule 506 of Reg D the vehicle for the vast majority of private offerings in the United States. American angels invested an estimated $24.8 billion in 2013 under this rule.

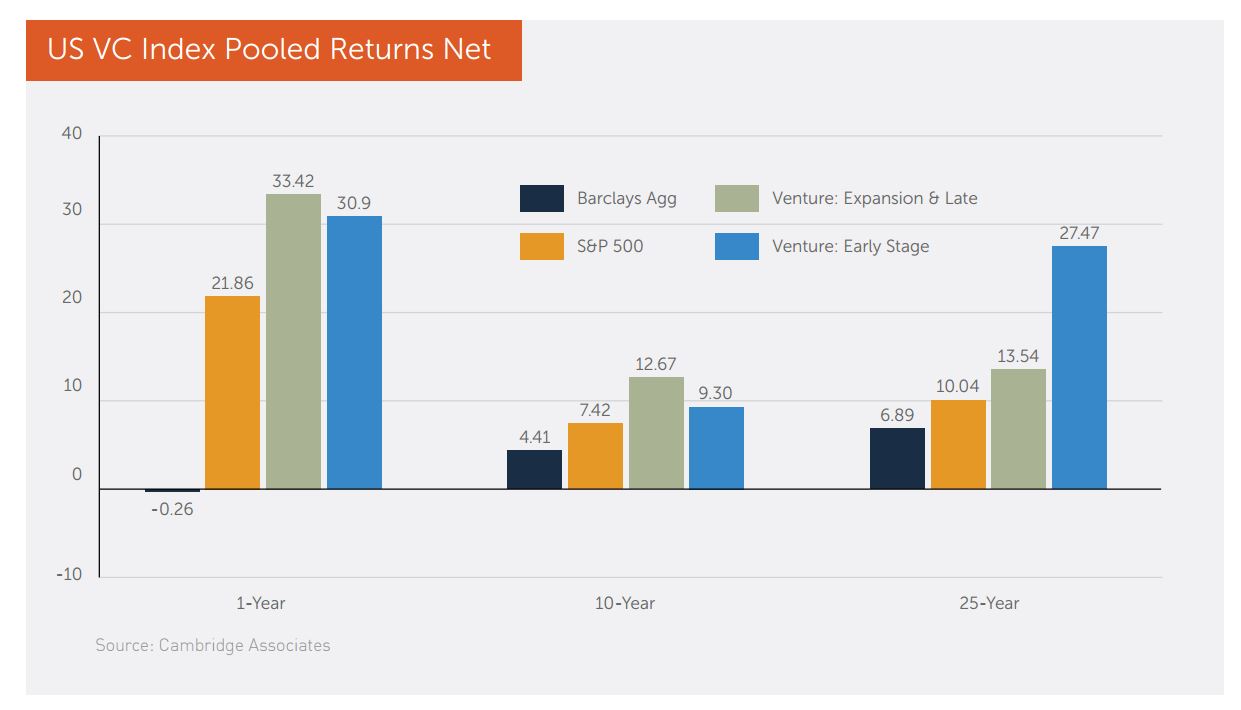

- As of late 2013, Cambridge Associates data18 show outperformance for the US Private Equity Index over public equities in 1-yr, 5-yr, 10-yr and 20-yr periods. Private equity investing represents a $426 billion market in the U.S. The data show average gross company returns above 18% IRR in both Private Equity and Venture Capital investments for companies receiving investments in the last three years.

-

Major Trends in Crowdfunding

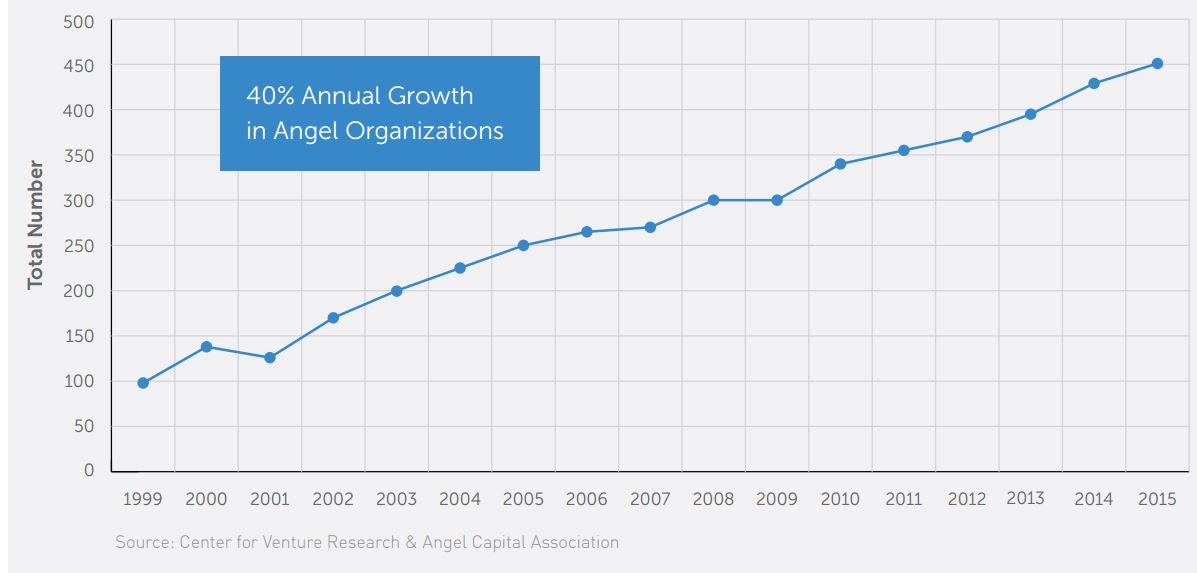

- Online platforms for accredited investors are fueling the continued growth in angel investing, according to the Angel Capital Association.

- Increased transparency by issuing companies should spur more equity offerings under Title II of the Jumpstart Our Business Startups (JOBS) Act, according to Equity Round.

- Crowdfunding is helping to fill the huge gap in funding for local businesses, according to report participant Breakaway Funding.

- Companies can use crowdfunding to access more investors with less administrative burden, according to OneVest.

Sector Opportunities

- Small brands, healthy snacks, and ethnic foods are three key, rising opportunities in the consumer and retail sectors for private equity investors, according to CircleUp.

- Real estate will continue to be a popular sector in 2015 for equity crowdfunding but the types of deals and investment vehicles will also expand rapidly, according to Early Shares.

- Deal quality is becoming increasingly important in the sports and entertainment sector as Internet platforms compete to build networks of investors says Alchemy Global.

- Equity crowdfunding is bringing institutional-grade transparency and broad access to real estate deals that historically were reserved for ultra-high-net-worth investors, according to Silver Portal Capital.

Tips for Investors

- Syndicators are driving interest in crowdfunding and offer investors lower minimums and a level of oversight, but investors need to look beyond the funding velocity popularity contest to find quality healthcare deals, according to HealthiosXchange.

- When considering an equity stake in film and television projects, investors should look for project slates, verified investments, lower minimums, and metrics, according to Indie CrowdFunder.com.

- Equity crowdfunding is one answer to the lessons of the global financial crisis, which showed that most investors need a wider range of assets to hedge against market shocks, according to SEEDCHANGE.

- In real estate, the market outlook remains solid and crowdfunding is increasing the use ofproject portfolios that allow accredited investors to test investment ideas and “spread risk” across multiple investments, according to LendZoan.

- By 2017 it is estimated that there will be more than 9.5 million high-networth investors in the United States, an increase of 68% from 2012, with the total wealth of this group increasing by 83% to just under $40 trillion. Similarly, the number of ultrahigh-net-worth investors — those with net assets of $30 million or more – is projected to increase by 67.7% to $39.6 trillion by 2017.

Source: 2015 PENSCO Crowdfunding Report

URL: http://info.pensco.com/2015-crowdfunding-report

http://cdn2.hubspot.net/hub/343005/file-2612198431-pdf/2015-Whitepaper_files-Retail/PENSCO_2015CrowdfundingReport_0315.pdf

Date: Mar 20, 2015

———————————————————–

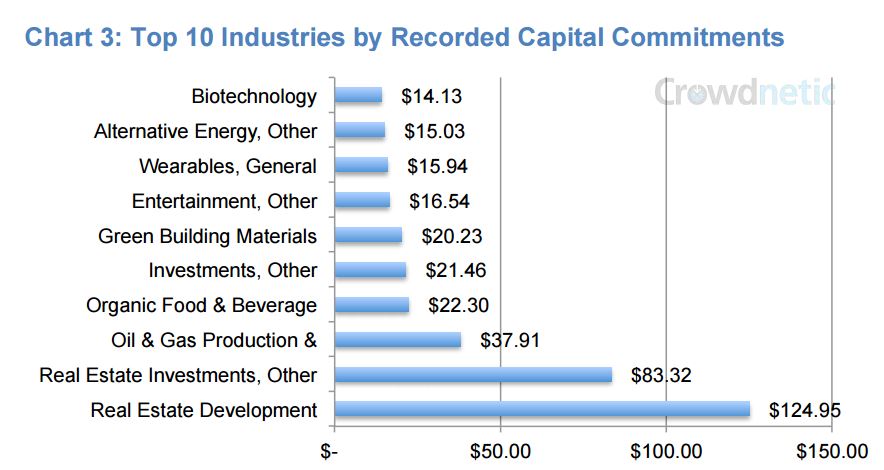

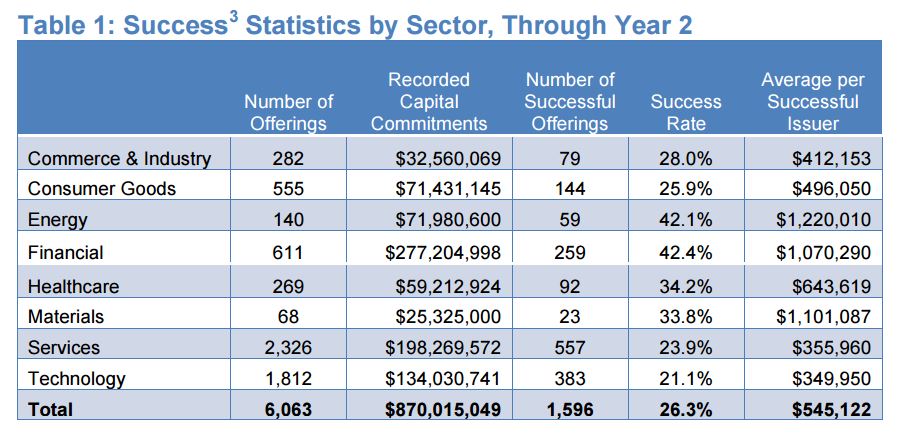

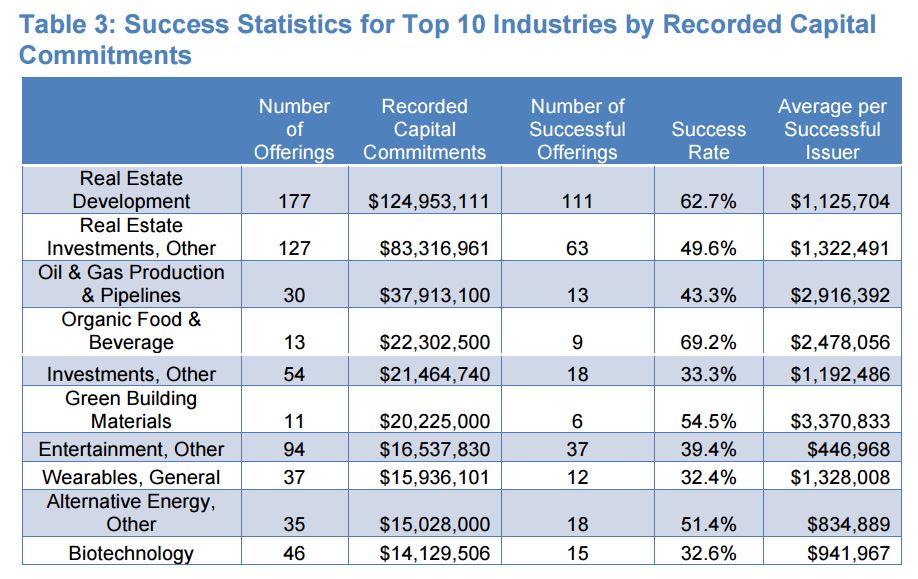

Crowdnetic Investment Crowdfunding Industry Report Sept 2015

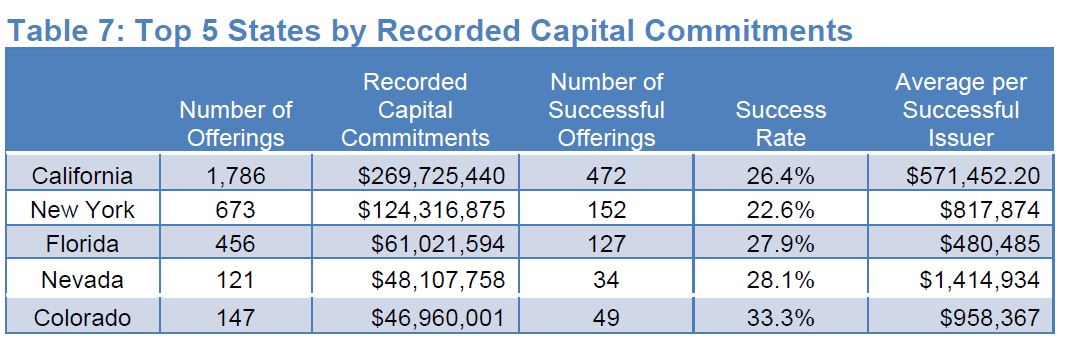

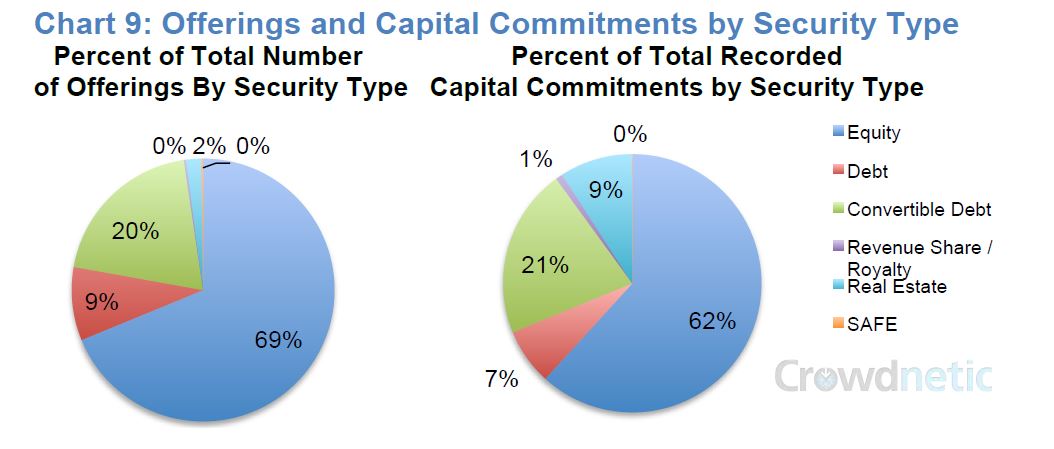

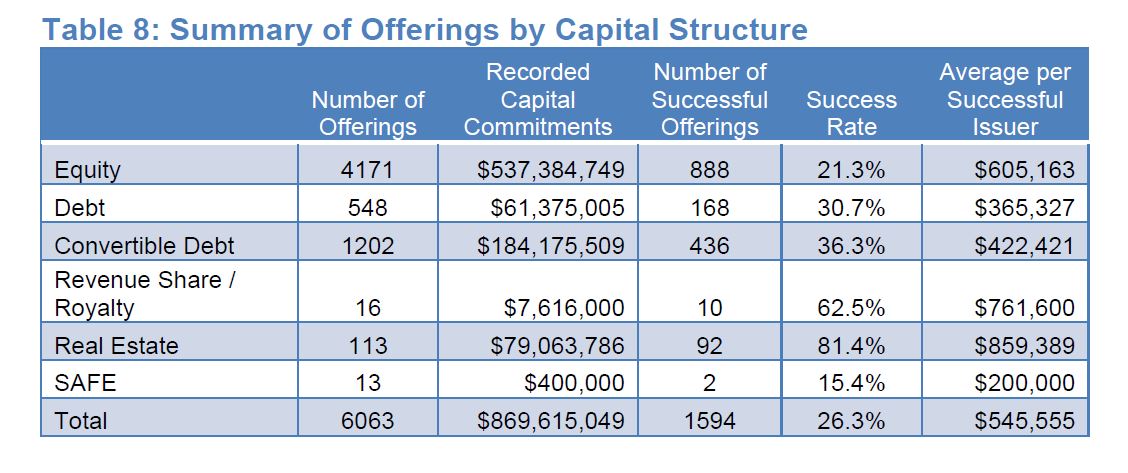

- Crowdnetic has tracked 6,063 Investment Crowdfunding private offerings which the JOBS Act Title II 506(c) rules, which have combined recorded capital commitments (“RCC”) of approximately $870.0 million in the two years between September 23rd 2013 (when Title II rules went into effect) and September 23, 2015 (the date of the report)

Source: Crowdnetic Quarterly Industry Reports

URL: https://www.crowdwatch.co/hosted/www/download-report?report_month=oct_2015

Date: Sept 23rd 2015

———————————————————–

SEC Study: Unregistered Securities Capital Raising in the U.S 2009-2014

- In 2014, there were 33,429 Regulation D offerings reported on Form D filings, accounting for more than $1.3 trillion raised.

- Issuers in non-financial industries3 reported raising $133 billion during 2014. Among financial issuers, hedge funds reported raising $388 billion and private equity funds $316 billion, while financial issuers that are not pooled investment funds reported $375 billion.

- Foreign issuers accounted for 20% of the total amount reported sold during 2014. Most foreign issuers are firms from Canada, Cayman Islands, and Israel.

- Rule 506 accounts for 99% of the amounts reported sold through Regulation D, including 97% of capital raised below the Rule 504 or Rule 505 offering limit thresholds, suggesting that issuers continue to value the preemption of state securities laws provided for offerings conducted pursuant to Rule 506.

- Since the effectiveness of Rule 506(c) on September 23, 2013 that eliminated the ban on general solicitation, only a small proportion (2%; $33 billion) of the capital raised in Regulation D offerings was raised in offerings conducted pursuant to Rule 506(c).

- Capital raised through Regulation D offerings continues to be positively correlated with public market performance, suggesting that capital formation in the unregistered market is pro-cyclical, i.e., the strength of the unregistered market is closely tied to the health of the public market. • Consistent with the original intent of Regulation D to target the capital formation needs of small business, the median offer size of non-financial issuers is less than $2 million. • Approximately 301,000 investors participated in Regulation D offerings during 2014. A large majority of these investors participated in offerings by non-financial issuers. Non-accredited investors were present in only 10% of Regulation D offerings.

Source: Capital Raising in the U.S.: An Analysis of the Market for Unregistered Securities Offerings, 2009-2014

URL: https://www.sec.gov/dera/staff-papers/white-papers/unregistered-offering10-2015.pdf

Date: October 2015

———————————————————–

SEC Study: Capital Raising Through Regulation D through 2014

- Total Amount raised via 506(c) Initial Offerings 2013-2014: $15.2 Billion

- Total Amount raised via 506(c) Follow-on Offerings 2013-2014: $8.4 Billion

- Total Amount raised via 506(c) combined 2013-2014: $33.6 Billion

- Total Amount raised via 506(b) Initial Offerings 2013-2014: $465 Billion

Source: Capital Raising Through Regulation D

URL: https://www.sec.gov/info/smallbus/sbforum112014-ivanov.pdf

Date: Aug 9, 2015

———————————————————–

Goldman Sachs Future of Finance Study 2015

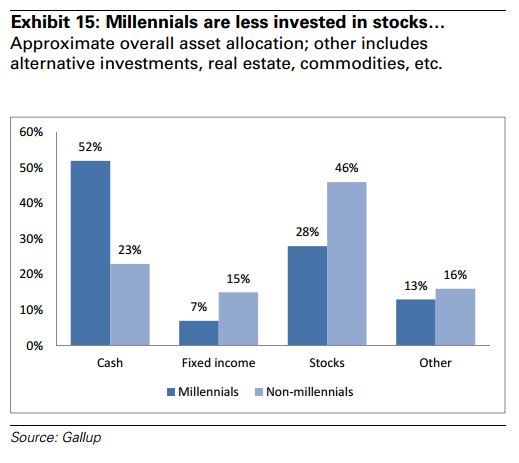

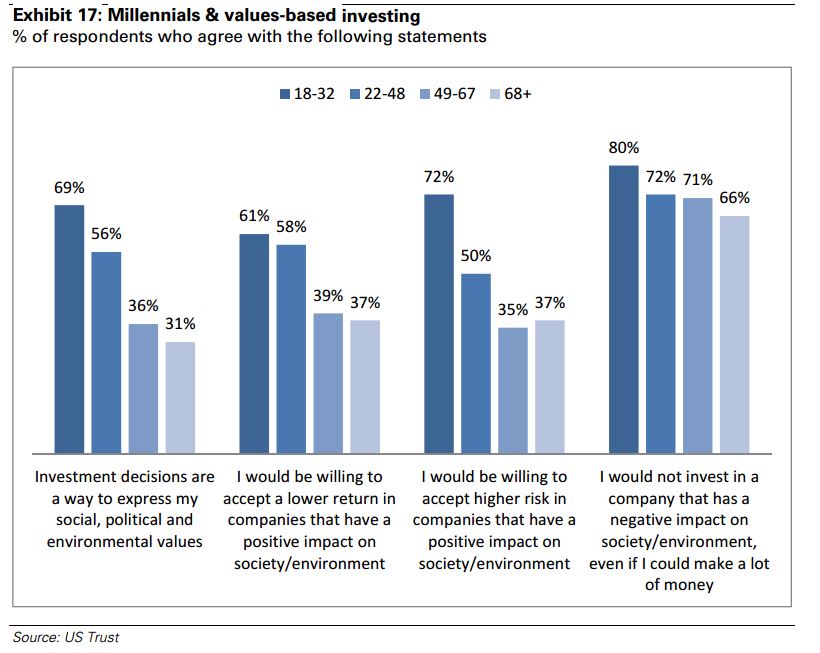

- “Demographics impact on equity crowdfunding Studies show that Millennials are less invested in stocks compared to prior generations. Millennials hold approximately 52% of their assets in cash and only 28% in stocks, compared to non-Millennials who hold approximately 23% of their assets in cash and 46% in stocks. However, Millennials are more likely to participate in crowdfunding; 47% of Millennial respondents have backed or are likely to back a crowdfunding campaign, compared to 30% of Gen-Xers, 13% of Boomers, and 4% of Matures. “

- On Demographic Preferences in Investing: “The nature of equity crowdfunding platforms could also appeal to Millennials who have a disproportionate desire for their investment decisions to reflect their social, political, and environment values. According to a survey by US Trust, Millennials are more likely to accept a lower return or a higher risk related to an investment if it’s in a company that has a positive impact on society and the environment, while less likely to invest in a company that has a negative impact on society and the environment despite potentially large monetary returns. Many crowdfunding platforms reflect various values; for example, the largest funded campaign on Indiegogo, An Hour of Code, funds an introductory hour of coding to students worldwide.”

- On Viral Growth: “Crowdfunding is inherently one of the most social categories of alternative financing, with the benefit of viral growth for specific campaigns. Groups of fans, such as those that funded the Veronica Mars movie on Kickstarter with $5.7mn, or early adopters, such as those that funded Oculus Rift’s first virtual reality headset with $2.4mn, have an incentive to share the campaign across their social networks and encourage their friends to join the campaign. Many campaigns can be easily shared owing to the nature of the campaign’s story and to show the altruism of existing supporters. Word of mouth serves as a particularly important driver of growth, especially among the Millennials generation. According to a Blackbaud survey, 65% of Millennials are “very comfortable” sharing the charities they have donated to, compared to 56% of Gen-Xers, 45% of Boomers, and 47% of Matures. “

- On Network Effects: “Crowdfunding platforms benefit from strong network effects whereby the value of the platform is enhanced as both campaigns and funders grow. The availability of campaigns drives potential funders to the platform seeking projects to back. Funding a campaign in turn incentivizes backers to leverage their social networks to help projects meet their goal, improving campaign success rate. The more projects funded draw more entrepreneurs and other creators to start campaigns on the platform, creating a virtuous cycle of growth on both sides of the marketplace. “

Source: Goldman Sachs Global Investment Research

URL: www.planet-fintech.com/file/167061/

Date: Mar 13, 2015

———————————————————–

Morgan Stanley Peer to Peer & Marketplace Lending Report

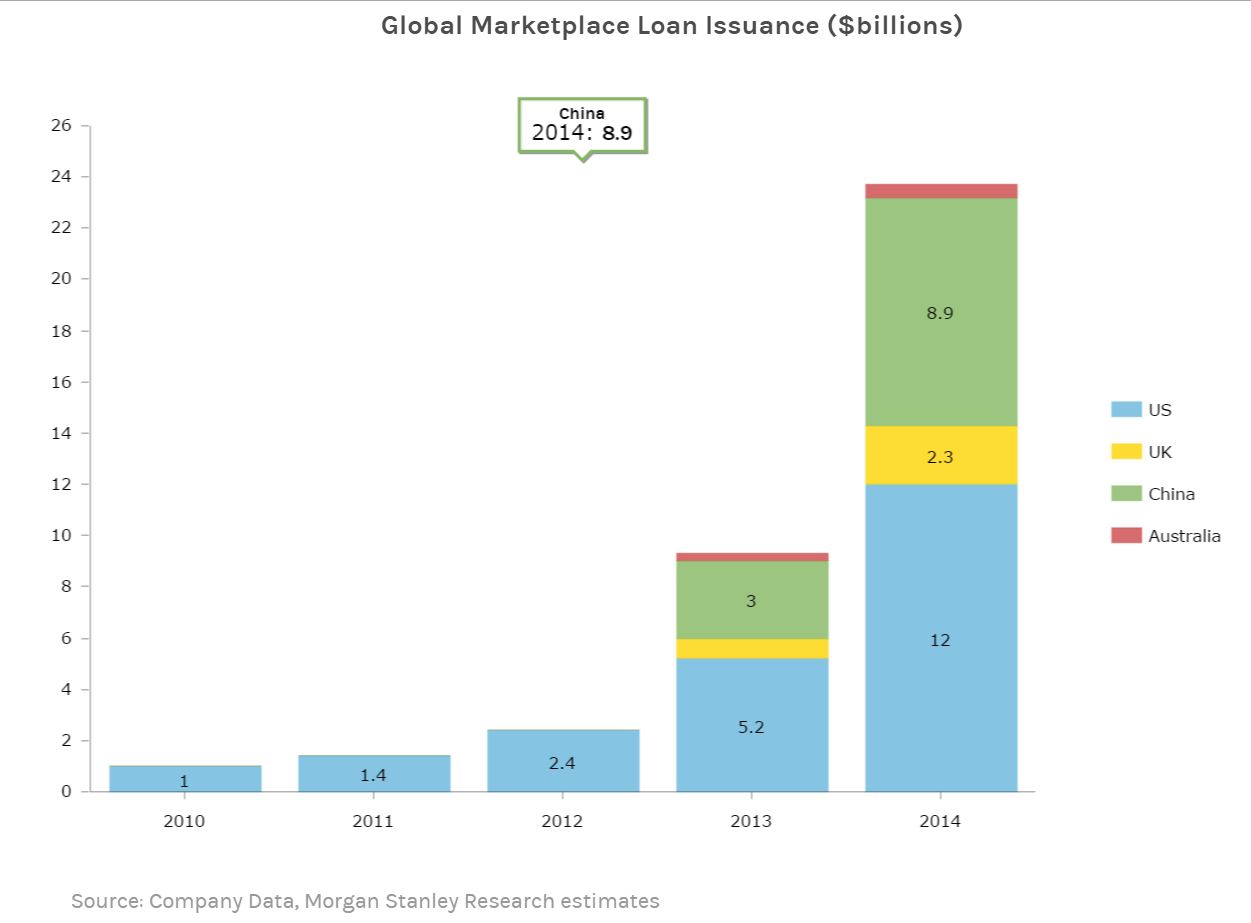

- These days, “marketplace lending” is a more fitting term for this evolving business. “The fastest growing marketplace platforms are not really peer-to-peer but institutional investors partnering with tech platforms to cherry-pick borrowers, often with offline marketing,” says Smittipon Srethapramote, who covers the North American payments industry at Morgan Stanley.

- In the US, marketplace loan origination has doubled every year since 2010, to $12 billion in 2014. Meanwhile, the trend is playing out globally, notably in Australia, China and the UK. All-told, such lending could command $150 billion to $490 billion globally by 2020.

- So far, marketplace lenders have focused on unsecured consumer credit, with roughly 80% of loans used to consolidate debt, and small business loans—with an estimated $100 billion in unmet demand solely in the US. But don’t be surprised to see these lenders make a play for the $1.2 trillion student loan market, auto loans and even mortgages. “It’s still more theoretical than proven,” says Srethapramote of a marketplace for mortgages, “but the value proposition makes sense to us.”

Source: Morgan Stanley Research Blue Paper, “Global Marketplace Lending: Disruptive Innovation in Financials” (May 19, 2015).

URL: http://www.morganstanley.com/ideas/p2p-marketplace-lending

Date: June 17 2015

———————————————————–

Deal Index: Democratizing Finance Report

- 2014 Total Equity Crowdfunding Volume: North America: $787.5 million, Europe: $177.5 million

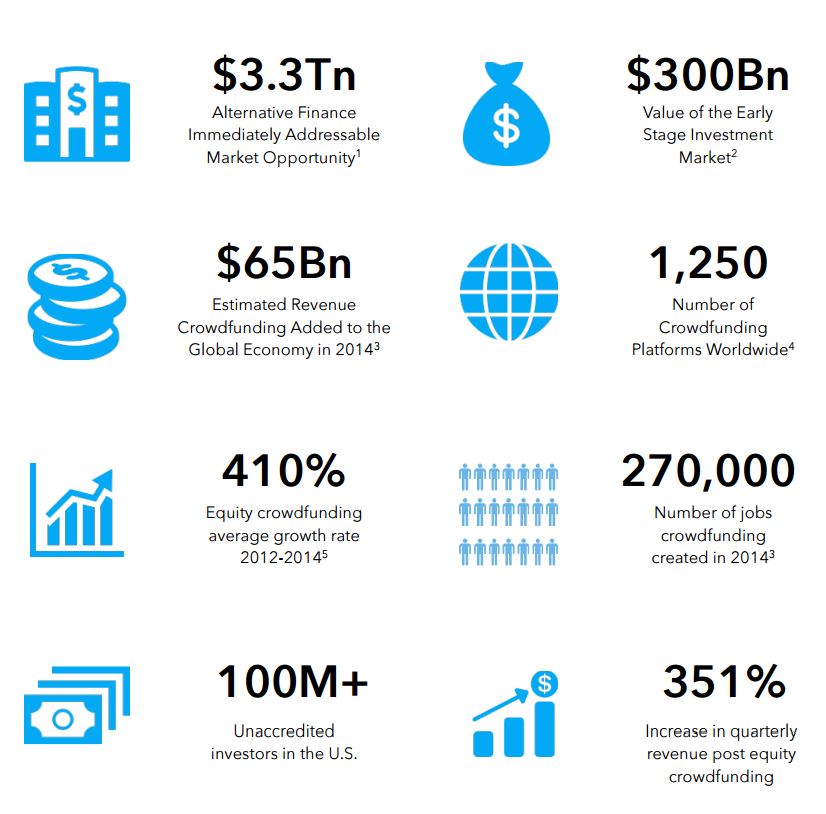

- DealIndex counts over 1,250 crowdfunding platforms worldwide

- Crowdfunding a $16.4Bn industry in 2014

- Total # Angel of Investors in the US: 268,000

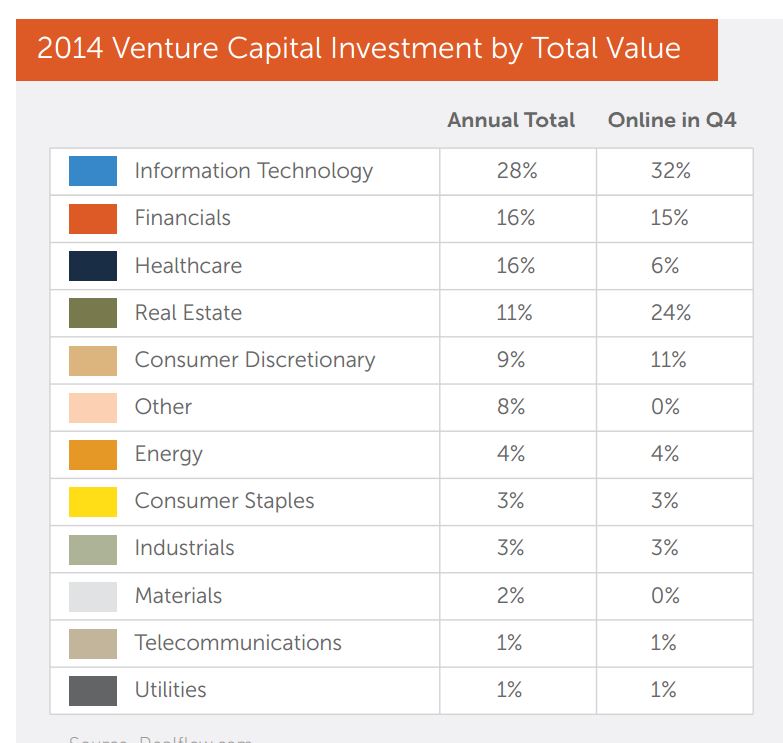

- Total # of VC Investors in the US: 522

- Total # of Angel Investment Deals in the US (Annually??) 67,000

- Total # of VC Deals in the US (Annually??) 37,000

- Total $ of Angel Capital Deployed in the US (Annually??) $23 Billion

- Total $ of VC Capital Deployed in the US (Annually??) $27 Billion

- Total # of Accredited Investors in US: 9 Million

- Total # of Un-Accredited Investors in US: 100 Million

Source: Deal Index – Democratizing Finance Report

URL: https://dealindex.co/research.html

https://www.dealindex.co/democratising_finance_dealindex_research_july_2015.pdf

Date: July 2015

———————————————————–

InfoDev Report: Crowdfunding’s Potential for the Developing World 2013

- Crowdfunding estimates at a $5Billion industry in 2013 according to study commissioned by the World Bank.

- Organizations such as the World Bank, governments, venture funds, and NGOs are watching crowdfunding closely to see whether it has the potential to solve the “last mile funding problem” faced by many start-up companies.

- Preliminary modeling estimates that the possible market potential for crowdfunding in developing countries could reach up to $96 billion a year over the next 25 years given the right answers to current regulatory, infrastructure and cultural challenges.

Source: InfoDev Report: Crowdfunding’s Potential for the Developing World

URL: http://www.infodev.org/crowdfunding

http://www.infodev.org/infodev-files/infodev_crowdfunding_study_0.pdf

Date: 24 October 2013

———————————————————–

CrowdFunder Industry Trends 2015

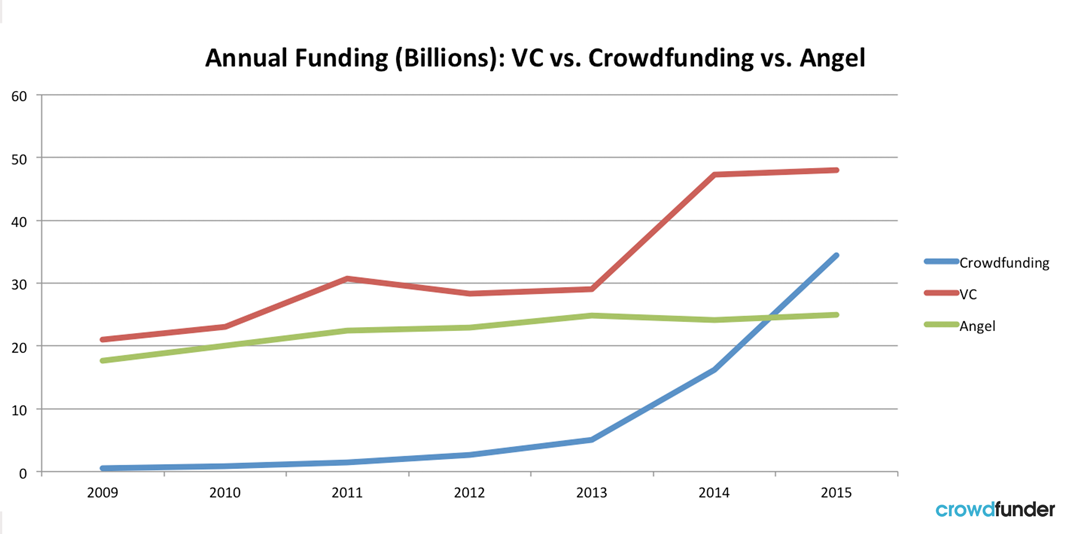

- Crowdfunding surpassed Angel Investing in 2015, on trend to surpass Venture Capital in 2016

Note. Seems to rely on the Massolution report numbers above, which include P2P/Marketplace lending as a part of Crowdfunding.

Source: Chance Barnett, CEO of Crowdfunder.com, in a piece on Forbes.com

URL: http://www.forbes.com/sites/chancebarnett/2015/06/09/trends-show-crowdfunding-to-surpass-vc-in-2016/3/

Date: June 19th 2015

CFX Alternative Investing Crowdfunding Statistics

- In 2015, equity crowdfunding portals will raise $34.4 billion. This is over 12 times the amount raised in 2012.

- The crowdfunding industry is projected to grow to over $300 billion by 2025.

- Title III and Regulation A+, the SEC’s new crowdfunding rules, will drastically expand the number of investors eligible to participate in equity crowdfunding offerings. The pool of eligible investors will expand from the roughly 8.5 million accredited investors in the United States to the entire U.S. population of 230 million.

- While the pool of eligible investors will expand, the average (mean) 401k balance in the United States is only $101,650, making liquidity crucial for retail investors.

- The total size of the U.S. commercial real estate market is $7 trillion. Crowdfunding makes up only $2.5 billion of this market, indicating much room for growth.

- 62% of self-directed IRA investors report that they either plan to or already have increased their allocation of non-traded alternatives in response to market volatility.

- Alternative assets are projected to account for over 26% of total institutional portfolios by the end of 2016.

- Between 1980 and 2000, an average of 311 firms went public every year. From 2001 to 2011, this number fell to an average of 99 IPOs per year.

- In the developing world, an estimated 344 million households, using savings, would be able to deploy $96 billion each year by 2025 in small crowdfunded investments in community businesses.

- Investors in technology startups currently have to hold their position in any one investment for an average of seven years.

Source: CFX Alternative Investing Crowdfunding Statistics

URL: https://cfxinvesting.com/blog/10-equity-crowdfunding-statistics-that-should-have-your-attention-infographic

Date: January 12th 2016